FINANCING : Local Taxes

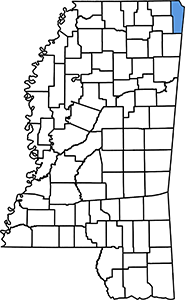

Mississippi has the lowest per capita tax burden in the United States. The average millage rate for Tishomingo County is 75.50 for 2005-2006, the fourth lowest tax rate in Mississippi.

Retirees do not pay state income tax on qualified retirement income. Social security is not taxed, regardless of total income. Qualified retirement income includes IRA's, 401/403's, Keogh's, public and private pension funds, and interest income from federal securities and obligations of Mississippi and its political subdivisions.

Retirees do not pay state income tax on qualified retirement income. Social security is not taxed, regardless of total income. Qualified retirement income includes IRA's, 401/403's, Keogh's, public and private pension funds, and interest income from federal securities and obligations of Mississippi and its political subdivisions.

Persons age 65 and older, or persons who are disabled, qualify for a property tax exemption up to $70,000 of the market value on homestead property.

The state's income tax rates are 3% on the first $5,000, 4% on the second $5,000, and 5% above $10,000. The standard deduction is $2,300 for singles and $4,600 for married couples filing jointly and/or as head of household. The same itemized deductions for the federal income tax apply with the exception of state income tax. Single taxpayers may claim a $6,000 exemption while joint applicants can claim $12,000. $1,500 is allowed for each additional exemption for dependents or for those 65 and older.

Real estate is assessed at 15% of market value. A homestead real estate tax credit of $240 applies to residential property used as the principle residence. Persons age 65 and older, or persons who are disabled, qualify for a property tax exemption up to $70,000 of the market value on homestead property. Any value over $70,000 is taxed the same as other property.

Vehicles are assessed at 30% of market value. This tax if reduced by a percentage assigned each year by the state legislature.

The state sales tax rate is 7% for most goods and services. There is no local sales tax except for a small tourism or hotel/motel tax. Prescription drugs, motor fuels, health care services, residential utilities, and newspapers are not subject to sales taxes. Click for print-friendly version.

Real estate is assessed at 15% of market value. A homestead real estate tax credit of $240 applies to residential property used as the principle residence. Persons age 65 and older, or persons who are disabled, qualify for a property tax exemption up to $70,000 of the market value on homestead property. Any value over $70,000 is taxed the same as other property.

Vehicles are assessed at 30% of market value. This tax if reduced by a percentage assigned each year by the state legislature.

The state sales tax rate is 7% for most goods and services. There is no local sales tax except for a small tourism or hotel/motel tax. Prescription drugs, motor fuels, health care services, residential utilities, and newspapers are not subject to sales taxes. Click for print-friendly version.